|

|

|

|

|

|

The Present State

World trade, growth and FDI flows

Sayed Alamgir Farrouk Chowdhury

WTO and FDI: This brief article is an attempt to reflect on the trend in the flow of world FDI and its role in the economy of Bangladesh. The developing and less developed countries have been very vociferous in their demand for a larger share of the world's resources, and the data on trends in world development and growth which show an accelerating gap, explains the reasons for such an emotional demand.

In the 60s, with the spread of literacy and democratic values, societies increasingly became more concerned about the need to grow faster, and to adopt strategies, which would ensure sharing of benefits and removal of poverty. Economists and policymakers gradually began to focus more on international trade and investments as being the prime movers. This started to have its perceptible impact, as growth began to accelerate

I think at this stage it may be useful to glance through the statistics relating to growth, trade and FDI.

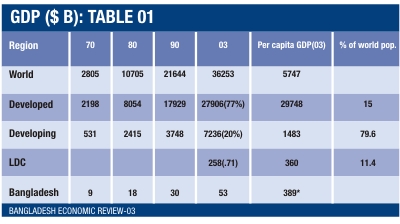

Bangladesh Economic Review-03

Some of the features of this trend are:

*The developed countries comprising 15 percent of the population control 77 percent of world income while LDCs with 11.4 percent of the total population account for just .71 percent of world income.*World GDP, as well as that of developing countries, more than trebled over the period '80-'03

Trade and development: Well, what triggered off growth was primarily international trade, a policy touted by western economists who controlled and continue to control the Bretton woods institutions like WB and IMF which began to heavily influence the policies of developing countries and LDCs. Some notable aspects of this growth are :

- World trade increased from $316 Bn in '70 to $8880 Bn in '04 of which developing countries' share was only 32%($2410Bn) and that of LDCs a mere .6%($44Bn)

- Trade in services grew from $391 Bn in '80 to $2100Bn in '04 of which the share of developing countries was about 22% and that of LDCs negligible.

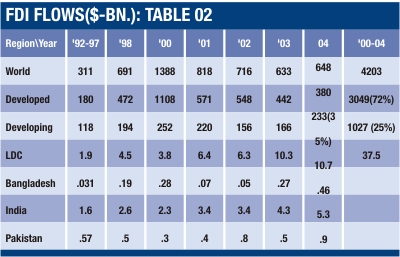

- FDI and development: Growth is contingent upon investments, and the above data on GDP and trade strongly bring out the increasing volume that was needed to support such accelerating growth. In case of developing/less developed countries, with a low national savings rate, FDI, the fuel for the engine of growth, becomes very critical to development as it bridges the gap between local demand and supply of funds. Trade generates resources, but, it also needs investments, as goods and services have to be produced, before being exported. I think, it may be useful at this stage to look at the trends in FDI, against the background of rising GDP and international trade. The figures by itself are indicative of the trade, growth and FDI nexus.

Significant aspects of FDI flow:

There has been a secular and significant rise in FDI during the past couple of decades, increasing from $311 B during 92-97 to 1388 in 2000 after which depressive trends, triggered by the shocks in financial market on account of the SE Asian financial crisis and the plateauing of demand from the developed countries, particularly US, caused the flow to subside significantly hitting a low of $633 Bn. in 03.It rebounded during 04.after a 3 year fall, increasing to $648 Developed countries continue to garner the flows(70 percent)The past couple of years saw a stemming of the rate of decrease, leading ultimately to the upturn last year, thanks to better and a more optimistic view of the market. The interesting point to note is that the economy of the developing and LDCs were more resilient to the shocks,

and in fact after a dip in 01and 02 in case of developing countries, and during '00 only in case LDCs, the flow has been rising.(iii)FDI and local consumption: FDI helped to supplement local resources and to provide funds for investment. With a low income and per capita consumption, stringent measures to squeeze out savings would only have further, eroded their purchasing ability.

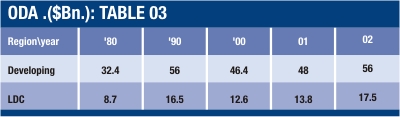

Private flows and ODA: The increased demand for funds were, and are being met by increased private capital flows of which FDI share has now, during '98-'02, risen to about 82 percent of total flows from about 30 percent in '80-'85.This has displaced bank lending and suppliers credit whose share fell from 69 percent of all private capital flows to 11 percent during the same period This contrasts with the latter half of the 80s and early 90s when official flows and FDIs were nearly equal.

ODA- ODA, which benefits the LDCs and many of the developing countries in the periphery, declined during the 90s in absolute terms, and has just about reached the level of a little over $56 Bn as during '90.ODA, to LDCs were however, higher than FDIs in the recent past, but continued to be nearly static at a meager average of $15 Bn.

Some more observations on the financial flows:

The average flow of ODA is a long way behind the committed figure of .7 percent, of developed countries GNI as aid. Some put this figure at present to be around 25 percentCapital formation: The average capital formation of LDC in the recent past was about 21 percent of GDP with local saving being 4.1 percent, leaving a gap of about 17 percent. Bangladesh performed reasonably in meeting the gap of 5 percent with a local sayings rate of 17.8 percent against the national capital formation of 23.78 percent. The dependence of the LDC and developing countries on FDI was higher than that of the developed countries, which in a way also reflects their vulnerability.

Change in composition of FDI: In tandem with the trend in both GDP and trade ,there has been a significant change in the composition of FDI between 1990 and 2002, the share of services increasing both in inward and outward FDI stock from 49 to 60 and 47 to 67 respectively. The share of primary goods also fell, along with that of manufacturing goods.

FDI and capital formation

*FDI flows as a share of world gross capital formation in '03 was about 7.5 percent while that of LDCs around 20.5 percent and that of Bangladesh 1.1 percent.*FDI stock as a share of GDP was about 20.7 percent in case of developed countries, 31.4 percent for developing countries, 24.5 percent LDCs, and 5 percent in case of Bangladesh.

* As is apparent it is only since the past couple of decades that FDI is coming to play a more critical role in case of poorer countries like Bangladesh.

Poverty and growth: It may generally be said, that a rising GDP, buttressed by investments, should ensure alleviation of poverty. However there are caveats in that the right mix of policies has to be in place to channel and ensure that the poor also benefit There are genuine causes for concern, whether globalisation of trade and capital flows have benefited many of the developing and less developed countries. The number of population in extreme poverty doubled over last 30 years from 138m in 60s' to 307 in 80s'.and so has the number earning $2 a day. If things continue the way they are UNCTAD estimates that the number of people living in extreme poverty will increase from 334 m in 2000 to 471 m in 2015. Similarly, the percentage of population under earning $1 a day increased from 48 in '65-'66 to 50 in '95-99

Fdi in Bangladesh

Growth, development and savings: With a per capita GDP of less than $400, and consequently low savings, the need for investment, particularly foreign investment, to propel growth is obvious. The TDR 03 emphasising on the need for investment, states.“The minimum level needed for a satisfactory growth performance will be influenced by country-specific factors, but a 20 per cent share of fixed investment in GDP has been suggested as a target threshold in poorer countries, rising towards 25 per cent as countries climb the income ladder.”

I feel it will be useful to briefly review the savings and investment scenario, so that we are better able to appreciate the need and flow of FDI.

The salient aspects of our economy relating to savings, and investments are:

- The per capita GDP is low and with a large population, substantial investments are needed to just stay where we are, let alone grow.

- The economy grew at an average of about 5 percent during the last decade., which is commendable, given the fact that the world GDP growth rate during '90-'03 was 2.6 percent and that of the developing countries, 4.4 percent.

- In spite of the occasional devastating floods, there was a secularly rising national savings and investments trend. National savings grew from 19.30 percent of GDP during 91-92 to 23.74 percent in 03-04 while investments grew from 17.3 to 23.2 during the same period, which however in absolute terms continues to be small.

- Public investments decreased as portion of GDP, while private investments grew. The shortfall in domestic investments was met by foreign investments of which FDI was an important component.

- Bangladesh adopted liberal policies and laws conducive to foreign investment as is evident from the fact that FDI stocks as % of GDP went up from 1.7 in 80 to 5 percent in 03.

Bangladesh Economic Review-03

FDI

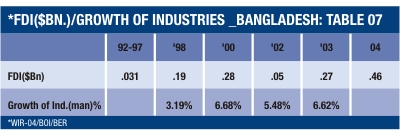

Bangladesh during the 90s continued to post a healthy rate of GDP growth at around an average of 5 percent supported by an investment rate which increased to about 23.7 percent in 03-04. It may be useful to refer to the data reflected in WIR04 (World Investment Report) and BER 03 (Bangladesh economic review), which gives us an idea about the FDI flows to Bangladesh in the context of global movement of funds. The data pertaining to Bangladesh as reflected in the WIR, do not tally with that supplied by BOI, which however in the overall context is not very material.A significant aspect of the flow of FDI to Bangladesh is that against the backdrop of falling World FDI flows, during '00-03, the amount of FDI reaching Bangladesh continued to rise.

Distribution by components of FDI:

BOI categorises FDIs flows, into three segments, the share of each in 2003 being, (i) Reinvestment-34.04 percent (ii) Equity-58.63 percent (iii) Intra company borrowing-7.34 percent.Sectoral distribution of FDI (2003)

A sectoral breakdown of the FDI, received in 2002 and 2003, indicate the areas of interest of foreign investors(BOI)Some conclusions

*Primary areas of support: Manufacturing accounts for about 70 percent of the investments followed by services. Now there is an increasing role of the service sectors which also includes investments in the energy and telecom sectors. In spite of the declining trend in investments in the energy sector, it still continues, along with the telecom sector, to offer the brightest prospects for investments.*Significant investments have been made in the textile sector, followed by Chemicals (mainly cement), telecommunications, energy, LPG bottling, agro-based etc. Support to the textile sector enabled the country to take advantage of the opportunity provided by the ATC in providing market access to developed countries. This sector now earns more the $5 b or about 75 percent of total export earnings besides spurring up the economy through interlinking impacts. By employing more than 1.5m females this sector has contributed not only to poverty alleviation but also to empowerment of women.

*Other sectors receiving investments include leather, drugs, metal, plastics, paper products, etc.

*Sources of FDI

The main sources are;(%)

*Europe- 47

*South/SE Asia -39

*W. Asia - 3

*North America- 8

* Japan others - 3Norway provided substantial support in telecom sector, the USA in services-sector including energy while Asia provided investments in manufacturing particularly textiles.

Impact of FDI in Bangladesh:

Complement savings: FDI plugged the gap in savings and provided the much needed investments of technology and capital, particularly in the energy and telecom sectors. It provided, besides the capital, the much needed foreign exchange. It supplemented the local savings of 18.33 percent to attain the national rate of 22.74 percent.Net inflow of resources: Focusing on receipts only could be misleading as an indicator of the total the resources available for investments, since substantial sums are to be paid on account of debt servicing. Based on the figures of BOI and BER, it is estimated that about 28 percent of total receipt of all resources , including that under ODA , flows out as repayments.

FDI stock: Inward FDI stock which was about 1.7 percent of GDP in 1980 has now(03) risen to 5 percent as compared to 27.4 percent and 34 percent for the same period in the case of South, East and SE Asia, countries.

Support to sectoral transformation: of GDP: This has supported the gradual transformation of the economy in that the share of industry in GDP has risen from 21.5 percent in 91-92 to 27.17 percent in 02-03, while that of services from 49.74 percent to 50.9 percent

Support to the industrial sector: The share of the industrial(manufacturing)sector continued to remain more or less static at just over 11 percent, while in absolute terms it increase from-Tk 327830 m in '98-'99 to Tk 462380m in 02-03. This was possible on account of the increase in national investments, to which FDIs contributed increasingly since 1998.

Apparently, Bangladesh, with the rise in her GDP growth, along with some dent in poverty ,which both the BBS and Poverty Monitoring survey shows as having decreased, has not fared badly. There has been some positive gains, but probably much more could have been achieved with the right mix of policies. This paper basically focuses on the trends in growth trade and FDI. How far it can help in ensuring a better life for the average citizen will depend on the manner we use both FDI, and the resources it generates ,and also have in place the complement of policies to ensure that the gains are not frittered away. Our objective should be to rope in as much of equity as possible and to guard against the volatility of international capital movements, whose debilitating impact we felt during the stock market crash of the late 90s. Policies have to be prudent, keeping in view future annual debt servicing which now at 6.3 percent of total foreign exchange earnings, is still within reasonable limits. It has to be ensured that such investments should be self-financing in the sense that the economy should be able to meet its amortisation liabilities or else we will be mortgaging the future for transient present gains. The financial crisis of the 90s involving the SE Asian tigers should be a stark reminder of how, even highly laudable and hyped policies could go wrong.

..............................................................................

The author is a former Commerce Secretary and currently associated with FBCCI and BEI.