|

|

|

|

|

|

How To Get More Of It

For sustainable human development

Mohammed Farashuddin

Growth essentially refers to growth in the size of an economy. It originated in the eighteenth century through 'Classical Dynamics' advocated, amongst others, by Adam Smith (The Wealth of Nations; 1776). Strange as it may sound, proponents of Classical Dynamics thought that land was unlimited and therefore, "free" as a factor of production. Investment of capital was not recognised as an identifiable component on the ground that 'labour' was making his/her own hunting, fishing and farming equipment. 'Labour' was also the organiser of production. Thus, of the four factors of production, land, labour, capital and organisation, labour was the sole determinant of production and, therefore, the entire output belonged to labour. In course of time, as population increased and all available land was occupied, many had to spread out into new areas of land where these continued with their production activity. In that scenario, which appears unreal now, real wage was constant because it was just the average output per labour there having been no other claimant to the output. Wage was the only factor of payment.

Breakdown of classical dynamics

The illusion of "free" land had to come to a halt at some point of time when the entire cultivable land was occupied by an ever-expanding population. Thus a person aiming at any expansion of production had to either purchase or lease land from the owners of land. In the total output, a rent payment for land became essential. Moreover, finite land started experiencing diminishing returns to scale and real wage decline was the inevitable outcome. Land became a factor of production and it also brought in a reason for real wage to decline.Malthusian pessimism

Rev. Thomas Malthus observed in 1798 that with a fixed supply of land and its diminishing returns, population growing in geometric proportion would far exceed the food production growing only in arithmetic proportion. People at or below the subsistence level would thus face severe shortage of food. Nature would intervene in eliminating the 'excess' population without access to food. Such elimination might take place through natural disasters such as volcano, floods, cyclones, tidal waves, tsunami, draught, epidemic or man made calamities such as war, famines, civil strife, ethnic violence, unbridled corruption, communal violence and terrorism.In recent times, Malthusian Pessimism which earned for economics the nick name of "the dismal science", resurfaced due to population explosion in developing countries, Sub-Saharan Africa in particular, oil price spurt since 1973, general decline in productivity in several economies and colossal degradation of the mother earth, the environment. But the fact that land did not suffer from diminishing returns in the developed world and in many developing countries was a major explanation why large scale death predicted by Malthus did not occur after all. Improvement in productivity, significant awareness about environment and search for alternative (renewable) source of energy were also instrumental in preventing large scale deaths. All these, however, made it absolutely clear that there was no alternative to economic growth. For growth to occur, capital accumulation and its investment in more and more productive economic activities were essential as was productivity increase through technological progress.

Neoclassical growth theory

Amongst the characteristics of the Neoclassical Growth Theory, the most significant one is that the law of diminishing returns could be beaten back by either technical progress in agriculture and/or deployment of more capital. But both of these required higher investment through accumulation of capital. One must be careful in noting that surplus income net of consumption expenditure qualifies to be called savings only after it gets into a Bank or another type of Financial Institution. The Bank or the Financial Institution then help the transformation of the savings into capital stock and into investment flows for increasing output as a multiple of the increase in investment. Financial Intermediation thus involves mobilisation of net income over expenditures as bank deposits and finding entrepreneurs for borrowing the savings for investment for growth in GDP.The convergence hypothesis

The neoclassical growth theory makes distinction between the growth prospects in a developing world with high capital per worker versus a developing country with a low capital per worker. The theory asserts that if a country has a low ratio of capital per worker (K/L ratio), then it does not take much to replace the existing capital and thus output/income itself can generate savings/investment for increasing the capital stock. Therefore, more resource can be deployed as additional capital per worker. As the deepening i.e. more capital per worker occurs, output per worker also increases because labour can now work longer hours and more productively or efficiently. This becomes the source of growth in GDP per capita.

But we are the producers of wealth!

However, if capital per worker is already high as in a developed country, more effort is needed for the current capital stock and less resource is available for creating additional capital per worker. Therefore, the growth rate will decline in the developed countries. If the growth rates in developing countries are faster as described above, the gap in the per capita income and the disparity in the standard of living shall disappear for a convergence to the same quality of life in the developed and the developing worlds.

However, available evidence shows that contrary to the 'Convergence Hypothesis' of the neoclassical optimists, the disparity between the income in the developed world and the developing world as well as the gap between standard of living of the rich and the poor are growingat a force stronger than ever before despite the growth in the global economy. Even the theory advocated by Robert Solow in the 1950s crediting capital accumulation and technological progress as the source of growth did very little to explain, let alone remedy the disparity in income and therefore, differences in the standard of living of the rich and the poor.

From growth to sustainable human development Measurement of welfare:

The question that must be asked by any Development Economist relates to not only on the determinant or the source of growth but also the reason for seeking growth. Growth essentially relates to the increase in Gross Domestic Product (GDP) of a country from year to year. GDP gives an idea about the size of the economy of a country. Per capita GDP or per capita GNP or per capita income is supposed to indicate the goods and services or average income per person per annum. Thus per capita income is meant to give an idea about the standard of living or state of welfare of an average citizen and a basis of its comparison over time and with that in other countries.In actual effect, however, because of purchasing power differences as well as taste and requirement variation from country to country, per capita income is not an accurate measure of welfare. Modern economists have designed different paradigms for showing the welfare level of people and its comparison with that in other countries. Human Development Index (HDI), formulated by the United Nations Development Programme (UNDP) one and a half decades ago has been the most promising so far.

HDI of a country is measured by the weighted average of (a) life expectancy at birth, (b) literacy rate coupled with the length of schooling, and (c) per capita income as a proxy for purchasing power. HDI comparisons provide a much more meaningful basis for judging the quality of life of the citizens of a country compared to that in other countries. According to the 2005 Human Development Report of UNDP, Bangladesh ranks 139 amongst 177 countries in HDI mapping with a value of 0.520 (out of a possible 1.00). It has elevated itself to medium level in the HDI category. Human Development Report 2005 shows the country's (a) average life expectancy at birth to be 62.8 years, (b) literacy rate to be 41.1 percent (the GOB estimates are above 62 per cent), and (c) GDP per capita on purchasing power parity basis to be US$ 1770. All the other South Asian countries, Sri Lanka (93), Maldives (96), India (127), Bhutan (134), Pakistan (135) and Nepal (136) are also in the medium HDI category but all ranked above Bangladesh. In the 2004 HDI ranking Bangladesh was also in the medium category ranking 138 with an HDI value of 0.509 as compared to Nepal at 140th and Pakistan at 142nd ranks.

Investment and growth in GDP: Recent trends

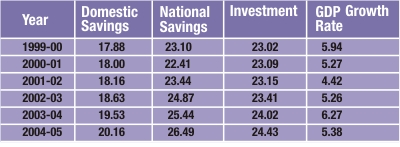

Despite differing emphasis on the relative weights in the contribution of different factor inputs or resources to the growth process, the truth that holds firm is that “no investment” means “no growth”. Traditionally, investment as a percentage of GDP is worked out on the basis of (a) the intended growth rate in GDP and (b) the capital: output ratio i.e. how many units of capital are needed to increase one additional unit of GDP (output). If the national savings rate defined as the domestic savings plus the savings by nationals working abroad (remittances) fall short of the intended investment: GDP ratio, the gap is filled up by savings done by others i.e. by external assistance.The following table shows the recent trends in the national savings, investment and growth rates as a percentage of GDP at the fixed price prevailing in the base year 1995-96:

Source: Bangladesh Economic Survey, 2005

From the above table, it is clear that for a 5.27 per cent growth in the year 2000-01, investment was 23.09 per cent implying that on an average 4.3 units of investment generate one additional unit of GDP. That will mean that for an annual growth of 8 to 10 per cent of GDP, we must generate 33 to 41 per cent of GDP as investment unless we make investment more productive by improving infrastructure. Thus source of growth is not only investment but also its productivity. If growth rate is to be increased, either the investment: GDP ratio is to be increased or capital: output ratio is to be lowered by improved physical and social infrastructure. It is also pertinent to note that higher GDP per capita is only a necessary condition for increasing the standard of living of people in general. The sufficient condition for an enhanced standard of living of the entire people depends, amongst others, on the translation of economic growth into social development, in fact, into sustainable human development based on equitable distribution of wealth.Illustration: Sabyasachi Mistry

.....................................................................

The author is a Professor of Economics at East West University and the Founder Vice Chancellor (1996-1998) of the University. He is also a former Governor of Bangladesh Bank.