Feature

The Invisible Mind of Adam Smith's Invisible Hand

Asrar Chowdhury

ADAM Smith's Invisible Hand is one of the most famous metaphors in economics. First introduced in Theory of Moral Sentiments (1759) the Invisible Hand also remains one of the most misunderstood and misinterpreted concepts in economics. The definition is simple - when economic agents act in self-interest they promote an end to which they themselves were not a part. Agents are guided by an invisible hand as they unknowingly promote the welfare of the society. A crucial assumption is that all agents act in self-interest to maximise benefits and minimise 'pains'. All agents are rational. Self-interested behaviour is the central theme of Smith's interpretation of the society.

The vulnerability of the invisible hand lies in the confusion between self-interested behaviour and selfish behaviour. Smith and later day economists needed self-interested behaviour to establish rationality as one of the foundations of economic behaviour. Self-interested behaviour coupled with rationality has at times made the economist's world look selfish. Economics had to wait for almost two centuries since Smith to interpret the difference between self-interested and selfish behaviour.

The central theme of the invisible hand is that even if individuals act selfishly an economic system can still function efficiently. Here selfishness refers to the impersonal relationship between individuals. Through the market, through the invisible hand, individuals interact not knowing each other or caring for each other per se. This does not logically imply individuals do not care about others. Neither did Smith believe individuals are universally selfish. It is this impersonal relationship that has been misinterpreted as selfish behaviour.

Two centuries after Smith it took the genius of two minds John von Neumann and Oskar Morgenstern to interpret Smith's invisible hand. This came in their revolutionary book, Theory of Games and Economic Behaviour (1944). Von Neumann and Morgenstern used utility as their starting point. They drew analogies from Physics. This is where the 'game' starts becoming interesting.

It is possible to predict the behaviour of each individual when the behaviour of very few individuals is observed. Can the behaviour of many individuals be predicted as the population becomes larger and larger? Von Neumann and Morgenstern found solace in thermodynamics. Temperature helps measure how fast molecules are moving. In theory it is possible to describe the velocity of a single molecule. What happens if we were asked to describe the velocity of millions, billions or even trillions of molecules? Physics teaches us that very large numbers are often easier to handle than small numbers. Even though it is not possible to track each and every individual molecule, it is very much possible to predict the aggregate behaviour of a large number of molecules. This works well in the physical sciences because molecules interact impersonally.

This impersonal relationship is exactly what Smith conjectured in the middle of the 18th Century, but failed to clarify. In page 13 of their book, von Neumann and Morgenstern write, “when the number of participants become really great … the influence of every particular participant will become negligible”. When the influence of each individual is negligible such that no individual can exert influence on the final outcome of the aggregate, economic agents are guided by an invisible hand via self-interest to promote an end to which they themselves were not a part. If the influence of any individual is insignificant to influence the final outcome of a system, there is no need for external (government) intervention- exactly what Smith conjectured, but has ever since been misunderstood and misinterpreted. This confusion has even lead to re-christening economics as a Dismal Science.

Adam Smith explained his universe with the 'invisible hand' using tools and concepts available to him. Original minds and original thoughts tend to be controversial because they come before their time. Today, with Game Theory we can decipher the mind of Adam Smith and other 'great economists' with greater precision and appreciate their genius. Game Theory helps distinguish self-interested behaviour and selfish behaviour with clarity thus creating the ground for the transformation of economics from a Dismal Science to an 'Intuitive Science'. That will require introducing the 'beautiful mind' of John Nash. Let that remain for another adda some other day.

(The writer is a teacher of Jahangirnagar and North South universities)

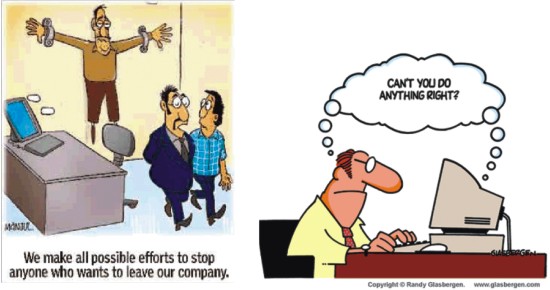

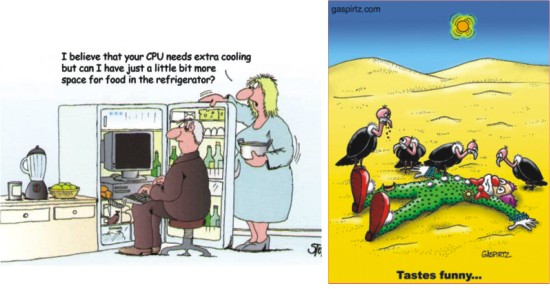

Funny Toons

|